We live in a hyper-connected digital world and it’s no secret that our information is bought and sold by scammers, no matter how cautious we are. The good news is, understanding and preparing for these scams can help you protect [Read more]

Low-Cost Renovations That Add Value to Inherited Homes

When it’s time to sell an estate property, the question of whether to update or renovate often comes up early in the conversation. The good news? A full remodel is rarely necessary. In many cases, small, thoughtful improvements can help [Read more]

What To Do Right After a Loved One Passes Away

Losing a loved one is never easy. While you are grieving, there are also many practical steps that need to be taken, often sooner than you expect. If you are feeling overwhelmed or unsure of where to start, this guide [Read more]

Maintenance Mistakes That Can Delay or Derail an Estate Sale

Inherited homes and long-vacant properties often come with small, overlooked repair issues. At first glance, these may seem minor or purely cosmetic. But for personal representatives, attorneys, and fiduciaries managing an estate, these small problems can lead to serious financial [Read more]

How to Talk to Family About Selling an Inherited Home

For many families, the home left behind by a loved one is more than just real estate—it’s a place filled with memories, meaning, and emotional ties. Deciding whether to keep or sell the property can be one of the most [Read more]

How to Spot Signs of Property Deterioration Early

A home that looks perfectly fine on the surface can hide serious issues that lead to expensive repairs down the line. For attorneys managing estate or trust properties, catching early signs of deterioration is critical for preserving a home’s value—and [Read more]

Local Burial Assistance Programs for Families in Need

At Colorado Estate Services, we recently had the privilege of meeting Kimberly Rosene, a Hospice Specialist at AdventHealth Porter Hospice. Kimberly’s dedication to supporting families during end-of-life transitions is truly inspiring. She shared invaluable information about local resources available to assist families [Read more]

How to Save on Taxes When Selling an Inherited Home

If you’ve inherited a property in Colorado, you may be surprised to learn that selling it could trigger capital gains tax. Fortunately, the IRS offers favorable treatment for inherited real estate that can significantly reduce, or even eliminate, your tax [Read more]

Attorney or Agent? How to Navigate Real Estate in Probate

If you’re managing an estate in Colorado, you’re likely juggling a long list of responsibilities—and facing some unfamiliar territory. One of the biggest questions we hear is: “Do I call a probate attorney first, or a real estate agent?” The [Read more]

How to Navigate an Estate Property Cleanout Without the Overwhelm

One of the most emotionally and logistically difficult parts of settling an estate is cleaning out the property. Whether the home has been well-kept or left neglected, the process of sorting through a loved one’s belongings can be deeply overwhelming [Read more]

Renovate or Sell? How to Sell Inherited Homes the Smart Way

One of the most common questions we get at Colorado Estate Services is: “Should I fix up the home before selling, or just sell it as-is?” If you’ve inherited a property or are managing the sale of an estate, this is a [Read more]

How to Sell an As-Is or Dated Estate Home Successfully

Not every estate home is HGTV-ready—and that’s okay. While some homes show beautifully with staged furniture and modern updates, others are sold as-is, needing cleaning, repairs, or a full renovation. But even a dated or distressed property can be marketed [Read more]

Selling Inherited Property in a High Rate Market

If you bought a home—or refinanced one—between 2020 and 2021, you likely locked in a mortgage rate in the 2.5% to 3.5% range. For many, it felt like hitting the jackpot. But now, with rates hovering above 7%, buyers and [Read more]

Hiring a Probate Realtor? Ask These Key Questions First

When a loved one passes away, selling the family home is often one of the biggest and most emotional tasks left to handle. It’s not just a real estate transaction—it’s a legal process that requires careful documentation, court approvals, and [Read more]

Spring Estate Home Maintenance Checklist: What to Tackle First

As winter fades and Colorado begins to bloom, spring is the perfect time to refresh a home—especially if you’re preparing an estate property for sale. Seasonal maintenance not only improves curb appeal but also helps preserve the value of a [Read more]

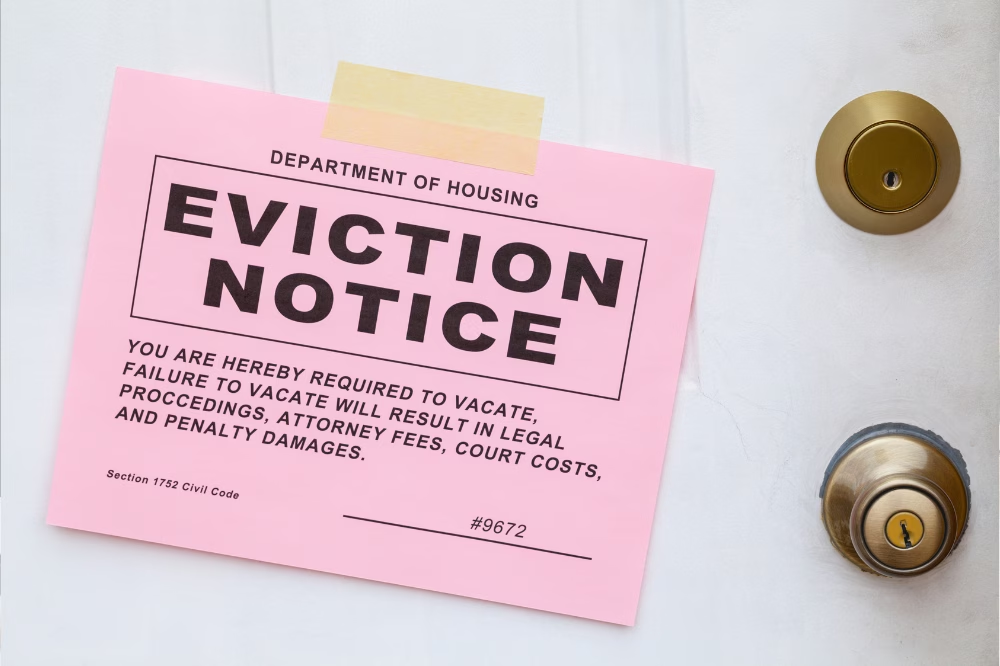

How to Manage Occupants in an Inherited Property

In probate situations, it’s often assumed the property will be empty—but that’s not always the case. In reality, many estate homes are still occupied. Tenants may still be living there under a lease or month-to-month agreement. Family members or heirs [Read more]

Red Flags That Turn Off Buyers and Simple Fixes

Estate and probate properties often come with their own unique set of quirks. From musty smells and stained carpets to outdated fixtures or years of accumulated clutter, these issues don’t always indicate serious problems—but they can quickly cause buyers to [Read more]

Big Results: 3 Estates Under Contract This Season

At Colorado Estate Services, 2025 is off to a fast-paced and productive start. We’re proud to share that three unique estate properties are now under contract, each following an extensive and thoughtful process of preparation, cleanout, and strategic marketing. Our [Read more]

Partner Spotlight: High Plains Restoration

Losing a loved one is always difficult, but when that person struggled with hoarding, the process of sorting through their belongings can feel overwhelming. At High Plains Restoration, we understand that this is more than just a cleanup—it’s a deeply [Read more]

Partner Spotlight: Kura Home Maintenance

At Colorado Estate Services, we understand the challenges of maintaining a home—especially when it’s vacant, part of an estate, or preparing for sale. That’s why we’re excited to partner with Kura Home Maintenance Colorado, a trusted name in professional home maintenance and winterization [Read more]